Hello, Elephants! Today, let’s take a deep dive into a critical topic that many of us may not consider carefully enough: emotional investing. When you invest in stocks that align with your personal values rather than sound financial analysis, it can feel good, but your returns might tell a different story. While it’s understandable to want to support businesses that align with your beliefs—like minority-owned companies or those advocating for racial justice—your portfolio’s health could take a hit if you’re not making these choices wisely.

Recently, there’s been increasing attention on investing in Black-owned businesses as part of broader social justice efforts. While this might seem like a great way to support important causes, it’s vital to assess whether this approach helps or hurts your financial returns. So, let’s explore why investing with your mind, not your heart, is the smarter way to build long-term wealth.

The Emotional Appeal of Investing in Black-Owned Businesses

Many investors want their money to reflect their values. The NerdWallet article “How to Invest in Black-Owned Stocks and Other Investments” promotes buying shares in Black-owned companies like RLJ Lodging Trust (RLJ), Urban One, Inc. (UONE), Carver Bancorp, Inc. (CARV), and Broadway Financial Corp. (BYFC) as a way to support racial justice while diversifying your portfolio. The idea is that by backing these businesses, you’re making a positive social impact.

But here’s the crucial question: How have these stocks performed financially? Because no matter how much you believe in a company’s mission, it won’t help your financial future if its stock is underperforming. Let’s compare how these stocks have done over time and see how they stack up against a broad market index like the S&P 500.

Stock Performance vs. the S&P 500

To really understand the financial impact of emotionally driven investments, we’ll look at how a $5000 investment in each of these Black-owned stocks would have performed over the past 12 months, 3 years, and 5 years, and compare that with the S&P 500. This comparison reveals the real cost of investing emotionally rather than strategically.

12-Month Comparison (October 9, 2023 – October 9, 2024):

- RLJ Lodging Trust (RLJ) (Yahoo! Finance Link):

- Final Value: $4737.50

- S&P 500 Final Value: $6817.50

- Loss compared to S&P 500: $2080.00

- Urban One, Inc. (UONE) (Yahoo! Finance Link):

- Final Value: $1464.50

- S&P 500 Final Value: $6817.50

- Loss compared to S&P 500: $5353.00

- Carver Bancorp, Inc. (CARV) (Yahoo! Finance Link):

- Final Value: $4828.00

- S&P 500 Final Value: $6817.50

- Loss compared to S&P 500: $1989.50

- Broadway Financial Corp. (BYFC) (Yahoo! Finance Link):

- Final Value: $4348.50

- S&P 500 Final Value: $6817.50

- Loss compared to S&P 500: $2469.00

In just 12 months, all four of these stocks significantly underperformed the S&P 500. The most shocking example is Urban One, where a $5000 investment would have shrunk to just $1464.50, compared to the S&P 500 investment growing to $6817.50.

3-Year Comparison (October 9, 2020 – October 9, 2023):

- RLJ Lodging Trust (RLJ) (Yahoo! Finance Link):

- Final Value: $5412.00

- S&P 500 Final Value: $6689.00

- Loss compared to S&P 500: $1277.00

- Urban One, Inc. (UONE) (Yahoo! Finance Link):

- Final Value: $4881.50

- S&P 500 Final Value: $6689.00

- Loss compared to S&P 500: $1807.50

- Carver Bancorp, Inc. (CARV) (Yahoo! Finance Link):

- Final Value: $1367.00

- S&P 500 Final Value: $6689.00

- Loss compared to S&P 500: $5322.00

- Broadway Financial Corp. (BYFC) (Yahoo! Finance Link):

- Final Value: $2304.00

- S&P 500 Final Value: $6689.00

- Loss compared to S&P 500: $4385.00

Over the 3-year period, the pattern of underperformance continues, with Carver Bancorp losing more than $5000 compared to the S&P 500. These results illustrate that when you invest with your heart instead of your head, you’re exposing yourself to significant financial losses.

5-Year Comparison (October 9, 2018 – October 9, 2023):

- RLJ Lodging Trust (RLJ) (Yahoo! Finance Link):

- Final Value: $2299.00

- S&P 500 Final Value: $9679.00

- Loss compared to S&P 500: $7380.00

- Urban One, Inc. (UONE) (Yahoo! Finance Link):

- Final Value: $10469.00

- S&P 500 Final Value: $9679.00

- Gain compared to S&P 500: $790.00

- Carver Bancorp, Inc. (CARV) (Yahoo! Finance Link):

- Final Value: $2251.50

- S&P 500 Final Value: $9679.00

- Loss compared to S&P 500: $7427.50

- Broadway Financial Corp. (BYFC) (Yahoo! Finance Link):

- Final Value: $3350.00

- S&P 500 Final Value: $9679.00

- Loss compared to S&P 500: $6329.00

The 5-year performance tells a similar story. Although Urban One managed to outperform the S&P 500, this is the exception rather than the rule. Most of the Black-owned stocks lagged far behind, with losses ranging from $6329 to $7427.50 compared to the S&P 500.

Why Emotional Investing Can Backfire

The numbers don’t lie. When you invest emotionally, it’s easy to ignore the critical financial fundamentals that every investor should consider. Investing based on values rather than data can lead to substantial underperformance. While the intention behind supporting causes like racial justice is admirable, the reality is that many of these stocks have struggled to deliver the financial returns needed to grow your wealth.

Let’s explore some of the key reasons why emotional investing can lead to poor outcomes:

Emotional Investing Creates Concentrated Risk

One of the most important rules of investing is diversification. By spreading your investments across different sectors and assets, you minimise the risk of one poor-performing stock damaging your portfolio. But when you invest emotionally, you often put too much money into a few companies based on their social mission. As we’ve highlighted in our article on value investing, it’s crucial to focus on companies with strong financial fundamentals rather than personal beliefs alone.

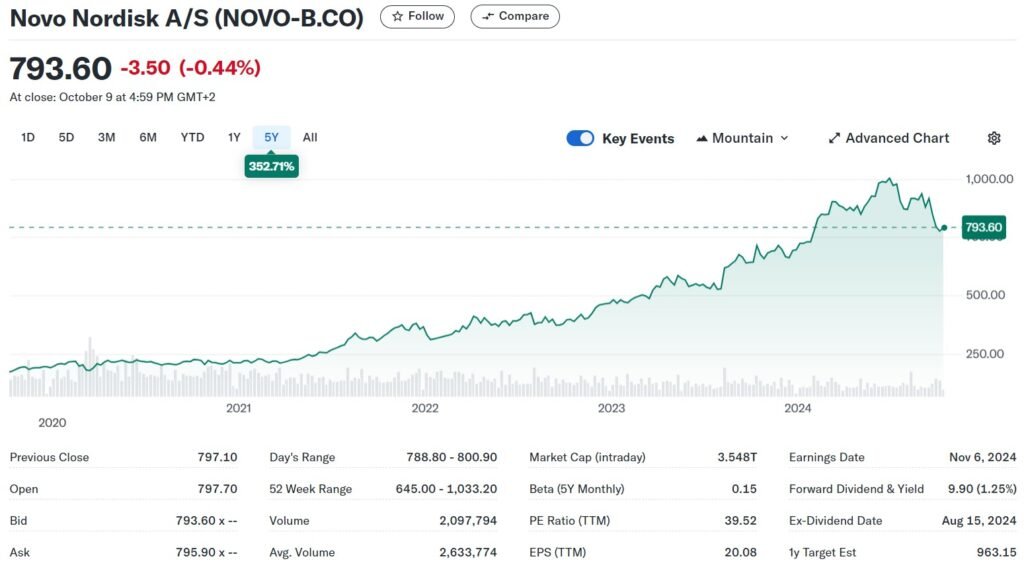

For example, Carver Bancorp lost over 70% in value over the past three years. If you were emotionally attached to this stock because of its mission, you would be facing massive losses today. Compare this to a stock like Novo Nordisk, which would over a 5 year period have given you a return on investment of 352%.

Supporting Black-Owned Businesses Without Hurting Your Portfolio

Don’t get me wrong, Elephants—supporting Black-owned businesses is crucial. But buying their stocks might not be the best way to do so, especially

if you’re a small individual investor. Your purchase of a few shares doesn’t provide the kind of capital that businesses need to grow. Instead, there are better ways to support Black-owned businesses that have a more direct impact:

- Shop at Black-owned businesses: Be a regular customer. When you buy their products or use their services, you’re directly contributing to their revenue.

- Donate to organisations that support minority entrepreneurs: Non-profits and community organisations are often better suited to provide the financial and business support that minority-owned businesses need to succeed.

- Invest in ESG or minority empowerment funds: These funds provide broader diversification and allow you to support social causes without exposing yourself to the concentrated risk of a single stock.

- Mentor or offer business guidance: If you have skills or expertise, consider offering your time to help Black-owned businesses thrive.

The Importance of Financial Fundamentals

At the end of the day, successful investing is about focusing on financial fundamentals. As we’ve discussed in our guide on personal finance mistakes, one of the biggest mistakes people make is letting emotions drive their decisions. This applies to both spending and investing.

A smarter strategy? Focus on value investing and diversify your portfolio to reduce risk. Companies with strong balance sheets, solid earnings, and good growth prospects are the ones that will help you build wealth over time.

Broader Ethical Investing: A Balanced Approach

If you’re passionate about ethical investing, there’s no need to abandon your values entirely. The key is to balance your ethical commitments with sound financial practices. ESG funds (Environmental, Social, and Governance) offer an excellent way to do this. These funds invest in companies with good ethical practices while still maintaining a diversified portfolio, reducing your risk compared to focusing on just a few niche stocks.

As we’ve discussed in our beginner’s guide to stock trading, diversification is a fundamental strategy that can help you build long-term wealth while avoiding unnecessary risks.

The Bottom Line: Think with Your Head, Not Just Your Heart

Investing is about building your financial future. While it’s commendable to support causes like racial justice, it’s essential to keep your financial goals in mind. Emotional investing can lead to significant losses, as we’ve seen with the performance of many Black-owned stocks.

Instead, focus on diversifying your portfolio, doing thorough financial research, and considering more balanced ways to align your investments with your values. This approach will help you achieve your financial goals while still supporting the causes you believe in.

Remember, your portfolio isn’t a donation. It’s an investment, and that means using your mind as well as your heart to make the best choices for your financial future.