Hello Elephants! Let’s talk about something that’s often at the heart of why we invest, budget, and plan for the future—financial freedom. You’ve probably heard this term a lot, but what does it actually mean? Financial freedom is a concept that looks different for everyone. For some, it’s about having enough money to cover basic needs, while for others, it’s about creating wealth to pass on to future generations. No matter where you are on your financial journey, understanding the stages of financial freedom can help you define and achieve your own version of it.

In this article, we’ll break down the different levels of financial freedom, starting with the basics and moving towards more advanced stages. Each step comes with its own challenges and rewards, and we’ll use some real-life examples to keep things clear and practical. So, whether you’re just beginning to get your finances in order or you’re already thinking about building a legacy, there’s something here for you!

1. Basic Financial Stability

The journey toward financial freedom begins with basic financial stability. This is the foundation upon which all other levels of financial independence are built. At this stage, your primary goal is to ensure that your essential living expenses—things like housing, food, utilities, transportation, and healthcare—are fully covered by your income. It’s about reaching a point where you don’t have to worry about meeting your day-to-day needs. While this might seem like a simple goal, many people struggle to achieve it, especially when living paycheck to paycheck.

To reach this level, it’s crucial to develop a deep understanding of your personal finances. Start by tracking your income and expenses. Knowing exactly how much money comes in and where it goes can help you identify areas where you might be overspending. Do you really need all those streaming services, or could you cut back? Are there ways to save on groceries or utilities? Small adjustments like these can add up over time, making it easier to manage your finances and feel in control.

One of the biggest mistakes people make at this stage is failing to budget effectively. Many underestimate the importance of a well-structured budget, assuming that as long as they aren’t splurging on luxury items, they’ll be fine. However, small, unnoticed expenses can accumulate quickly and derail your financial stability. Budgeting helps to create a clear picture of your financial health, allowing you to prioritise essential costs while cutting down on unnecessary spending. For more insight into avoiding common financial missteps, check out our guide on Top 10 Personal Finance Mistakes and How to Avoid Them.

The aim here isn’t to build wealth—yet. Instead, it’s about covering the basics without sinking into debt or constantly worrying about money. Reaching this point might take time, especially if you’re starting with a tight budget or existing financial struggles. However, the peace of mind that comes from knowing you can cover your essentials without relying on credit cards or loans is invaluable. Once you achieve this, you’ll be in a much stronger position to move toward the next stage of financial freedom.

Building up to basic financial stability also requires some sacrifices. You might need to delay some of your short-term wants, like a holiday or a new car, in order to focus on necessities. However, it’s important to remember that this stage is a stepping stone toward a much more comfortable and flexible financial life. The more disciplined you are now, the quicker you’ll move on to greater financial freedom. By living within your means and creating a solid financial foundation, you’ll be ready for the challenges and opportunities that come with the next level—debt freedom.

2. Debt Freedom

After securing basic financial stability, the next milestone on the path to financial freedom is debt freedom. Debt can be one of the most significant barriers to financial independence, weighing you down with interest payments and limiting your ability to save or invest. Whether it’s credit card debt, student loans, or a mortgage, the longer you carry debt, the more money you lose to interest, and the harder it becomes to achieve your financial goals. Reaching debt freedom is about eliminating these financial obligations and reclaiming control over your income.

One of the most common forms of debt that people struggle with is credit card debt. Credit cards can be useful financial tools when managed properly, but they often come with high interest rates that can spiral out of control if not paid off promptly. For many, paying only the minimum balance each month becomes a vicious cycle, where the bulk of their payments go toward interest rather than reducing the principal debt. To break free from this, it’s essential to create a focused repayment plan. Start by prioritising high-interest debts while making at least the minimum payments on the others. As you knock out the most expensive debts, you’ll free up more money to tackle the remaining balances faster.

Student loans are another common source of debt, especially for younger people just starting their financial journey. Unlike credit cards, student loans often have lower interest rates and more flexible repayment options, but they still represent a significant financial burden. Tackling student loans early, or at least developing a plan to manage them efficiently, is a key step in the debt freedom process. Consider taking advantage of any opportunities to refinance your loans for a lower interest rate or to make extra payments when possible.

Mortgages, while often viewed as “good debt,” still need careful attention. Paying off your home loan early can provide immense peace of mind, even if it’s not always the most urgent debt compared to high-interest obligations like credit cards. For many, a mortgage is the largest debt they will ever have, and becoming mortgage-free is often seen as a major milestone on the road to financial freedom. However, it’s important to weigh the pros and cons. Sometimes it may be more beneficial to invest any extra money rather than aggressively paying off a low-interest mortgage, depending on the current market conditions. For insights into making smart investment decisions, have a look at our beginner’s guide: A Brief Intro to Stock Trading for Complete Beginners.

Once you’re debt-free, you’ll no longer be held back by monthly payments to creditors. Instead, you can start focusing on building wealth and working toward other financial goals, like saving for retirement or pursuing lifestyle freedom. The transition from being weighed down by debt to being able to allocate your income to savings and investments can feel liberating. It also gives you more flexibility in life choices, as you’re no longer constrained by financial obligations.

Debt freedom is a critical part of the broader financial independence journey, but it requires discipline and careful planning. The earlier you can eliminate debt, the sooner you can start putting your money to work for you, instead of paying interest to others. If you want to avoid the pitfalls that lead to unnecessary debt, revisit our tips in the article Top 10 Personal Finance Mistakes and How to Avoid Them.

3. Emergency Fund Preparedness

Once you’ve achieved basic financial stability and debt freedom, the next step toward financial freedom is ensuring you’re prepared for life’s unexpected events by building an emergency fund. Life is unpredictable—whether it’s a sudden job loss, an unexpected medical bill, or a car breakdown, financial emergencies can strike at any time. Having a well-stocked emergency fund is the buffer that keeps these surprises from derailing your financial progress.

An emergency fund is typically 3 to 6 months’ worth of living expenses, though some prefer to save even more depending on their personal situation. The idea is to have enough money set aside to cover your basic needs for an extended period in case of a significant disruption, like losing your job or facing a major repair expense. If you have a family or own a business, you might want to aim for the higher end of the savings range, as your financial responsibilities are likely larger.

It’s crucial that this fund remains liquid, meaning it should be easily accessible in a savings account or a similar low-risk, low-return vehicle. You don’t want to put your emergency fund in stocks or real estate, as these investments can fluctuate in value and might not be easy to cash out quickly if needed. The goal is security, not growth—this money should be available when you need it, no questions asked.

Now, how do you go about building this fund? Start by setting a monthly savings goal. Even if it’s a small amount, like £50 or £100 per month, consistency is key. Gradually, as your debt decreases and your financial situation improves, you can increase your savings contributions. Another effective strategy is to channel any extra income, such as tax refunds, bonuses, or even money saved from cutting back on unnecessary expenses, directly into your emergency fund.

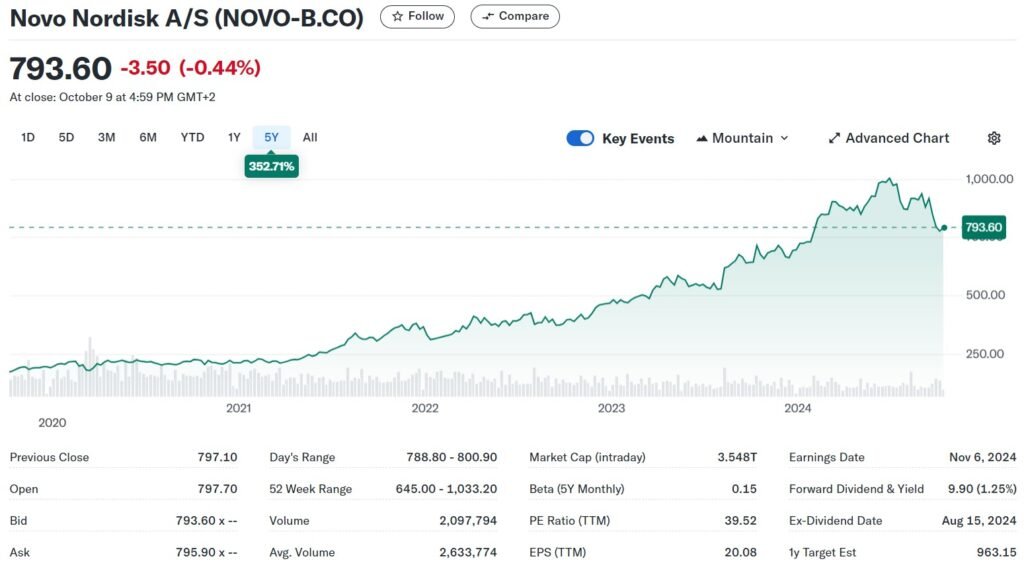

This level of financial preparedness gives you peace of mind, allowing you to handle unexpected expenses without having to rely on high-interest loans or credit cards. This is especially important when it comes to safeguarding your long-term financial goals. For example, instead of being forced to sell your investments or dip into retirement savings to cover an emergency, your emergency fund keeps your financial plan intact. Stocks like Novo Nordisk and Nvidia, which have shown strong market performance, can be used to grow your wealth, not cover short-term setbacks. (For more on these investment opportunities, check out Novo Nordisk: Time to Invest? and Why Nvidia’s Stock Price Is Surging).

An emergency fund is a safety net, ensuring that you can continue working towards larger financial goals even when life throws you a curveball. The comfort that comes from knowing you’re prepared for the worst is worth every penny saved. So, whether it’s a sudden job loss, an unplanned medical expense, or a car repair, you’ll be ready to face it head-on without derailing your progress toward financial independence.

4. Lifestyle Freedom

After securing your basic needs, becoming debt-free, and building an emergency fund, the next stage in your journey toward financial freedom is achieving lifestyle freedom. This level of financial freedom is all about having the flexibility to live life on your own terms. At this point, your income comfortably exceeds your regular expenses, allowing you to make choices based on preference, not necessity. Imagine being able to travel, pursue hobbies, or even make large purchases without worrying about draining your savings.

Lifestyle freedom doesn’t necessarily mean extravagance; it’s about choice. Whether you want to take a year off to travel, buy a second home, or simply work fewer hours to spend more time with family, lifestyle freedom is about aligning your money with your personal desires. To get to this stage, you need to have solid financial habits in place, and the income to support them. For most people, this is where investment strategies play a key role.

One of the best ways to increase your income and reach lifestyle freedom is by investing wisely. At ElephantInvestor, we often talk about how smart stock investments can accelerate your journey. For instance, learning how to identify value stocks that can provide steady returns over the long term is crucial. Value stocks—those that are undervalued by the market but have strong financials—are a great way to grow wealth without taking on excessive risk. If you’re new to investing or unsure where to start, our guide to Understanding Value Stocks: How to Spot Them and Invest for Long-Term Gains offers a helpful overview of how to identify these opportunities.

At this stage, lifestyle freedom also means increasing your discretionary spending—money you can use for non-essential activities. You might invest more in experiences like travel or hobbies, which contribute to your personal satisfaction, while still keeping your long-term financial goals in check. This is where a balance between enjoying life today and planning for tomorrow becomes important. You can start thinking about making significant lifestyle choices, like upgrading your home, taking a long vacation, or even switching to a less stressful job that pays less but aligns with your personal values.

It’s also a time to think about diversifying your investments. As you accumulate more wealth, consider branching out into different asset classes like real estate, stocks, or bonds to secure your financial future. If you’re already comfortable with the basics of stock trading, you might explore forex trading as another avenue to grow your wealth. Forex, or foreign exchange, involves trading currencies and can be a lucrative market if you understand the risks and rewards. To learn more about it, check out our detailed guide on What is Forex?.

Ultimately, lifestyle freedom isn’t about having unlimited money; it’s about having enough financial security and autonomy to make choices based on what brings you joy and fulfilment. It’s about building a life where money is a tool that enhances your freedom, not something that dictates your every decision. From this point, many people start thinking about the next stage: financial independence.

5. Financial Independence

Achieving financial independence is often seen as the ultimate goal of financial freedom. This stage is defined by having enough passive income to cover your living expenses without needing to rely on a traditional job or an active income. When you reach financial independence, you have the freedom to stop working entirely or choose to work on things you’re passionate about rather than working out of necessity.

Passive income typically comes from investments like stocks, bonds, real estate, or businesses that generate cash flow without requiring you to actively work. Building a portfolio of value stocks that provide dividends, or investing in rental properties, are common strategies people use to achieve financial independence. The key to this stage is having enough assets that generate sufficient returns to cover your cost of living, so you’re no longer tied to a 9-to-5 job to make ends meet.

For many, the path to financial independence begins with investing in the stock market. When done properly, long-term investments in well-performing stocks can yield significant passive income. Our guide on How Much Should I Invest in the Stock Market? provides a framework for how much of your income should be allocated to investments, helping you build the foundation for financial independence.

Another important aspect of reaching financial independence is understanding risk and reward in your investments. This is where diversifying your portfolio can help. As we discuss in our articles, balancing your investments between high-growth sectors (like tech stocks) and more stable, dividend-paying stocks allows you to generate a mix of growth and income. Companies like Nvidia have surged in recent years due to advancements in technology, and many investors have benefited from this growth. However, it’s crucial to have a balanced approach that also includes safer investments, which can provide a steady flow of income. (For more on Nvidia’s recent success, check out Why Nvidia’s Stock Price Is Surging).

It’s also essential to revisit your financial goals regularly. What does financial independence mean to you? For some, it’s about retiring early and living off their investments, a concept popularised by movements like FIRE (Financial Independence, Retire Early). For others, it’s about having the flexibility to work part-time, pursue personal projects, or even start their own business without worrying about generating income. Whatever your personal goal is, having a solid financial plan that includes saving, investing, and risk management is crucial to achieving and maintaining financial independence.

Reaching this stage takes time and discipline, but the rewards are worth it. Financial independence opens the door to true freedom—freedom to spend your time how you choose, to focus on what’s most important to you, and to live without the stress of worrying about money.

Reddit also has a subreddit dedicated to just this!

6. Wealth Accumulation and Legacy Planning

For some Elephants, financial independence is just the beginning. Beyond that lies the realm of wealth accumulation and legacy planning. At this stage, financial freedom isn’t just about having enough to live comfortably; it’s about creating generational wealth—building assets that will benefit your family and future generations. It’s also about shaping how you want your wealth to be used after you’re gone, whether that’s through supporting family, philanthropy, or leaving a lasting impact.

The first step in this stage is continuing to grow your wealth through strategic investments. Now that you’re financially independent, you have the flexibility to take calculated risks with your money. Stock trading remains a powerful tool for wealth accumulation, but at this level, you’re likely diversifying into other assets such as real estate, private equity, or even starting new business ventures. As you accumulate wealth, it’s important to consider the long-term strategies for managing and growing it. Our guide on Understanding Value Stocks can help you navigate these options as you build a portfolio designed to create long-term wealth.

But wealth accumulation isn’t just about growing your personal assets; it’s also about planning for the future. This is where estate planning comes in. Estate planning ensures that your wealth is distributed according to your wishes, whether that’s passing on your assets to your heirs or donating to causes you care about. Trusts, wills, and charitable foundations are some of the tools you can use to ensure that your wealth is used in ways that reflect your values and priorities.

If your goal is to leave a legacy for your children or grandchildren, consider the importance of financial education. Passing on your knowledge about smart investing, saving, and wealth management is just as important as passing on money itself. Teaching your descendants how to handle wealth responsibly can ensure that the benefits of your financial freedom are enjoyed by future generations.

Additionally, this stage allows you to think about philanthropy. Many wealthy individuals choose to donate part of their fortune to causes they are passionate about, either through direct donations or by setting up charitable foundations. Creating a lasting impact through philanthropy can be one of the most fulfilling aspects of financial freedom.

Building a legacy goes beyond just accumulating wealth—it’s about creating a meaningful, lasting impact. Whether you want to support your family, give back to your community, or establish a philanthropic foundation, wealth accumulation and legacy planning allow you to shape the future in a way that reflects your values and priorities.

7. Freedom of Time

For many Elephants, the most rewarding aspect of financial freedom is achieving freedom of time. This stage isn’t just about having enough money; it’s about reclaiming control over how you spend your days. Once you’ve achieved financial independence, you no longer need to trade your time for money. This gives you the flexibility to focus on the things that truly matter—whether it’s spending more time with your family, travelling the world, or dedicating yourself to a passion project or personal goal.

Freedom of time is a concept that shifts the focus from building wealth to enhancing quality of life. Imagine waking up every morning and being able to choose what you want to do, rather than what you have to do. This stage of financial freedom is deeply personal—it’s about aligning your time with your values. For some, it means early retirement, while for others, it means cutting back on work hours to achieve a better work-life balance.

One of the key strategies for achieving time freedom is to create multiple streams of passive income. Passive income can come from various sources—rental properties, dividend-paying stocks, or even a side business that requires minimal day-to-day involvement. By having a steady flow of passive income, you’re free to step away from a traditional job without sacrificing financial security. At this stage, the goal is to maintain your standard of living without being tied to a job or other financial obligations.

The FIRE (Financial Independence, Retire Early) movement is a great example of how individuals aim for time freedom. By aggressively saving and investing, people in the FIRE community work to reach financial independence as quickly as possible, often in their 30s or 40s, so they can enjoy decades of free time. If you’re interested in learning more about passive income strategies, you can explore options like forex trading or building a solid stock portfolio. Our article on How to Read Forex Charts is a useful starting point for those considering trading as a way to generate passive income.

Ultimately, time freedom allows you to live a life that’s more aligned with your personal goals. Whether you want to spend more time with loved ones, travel, or simply relax and enjoy life without the pressures of work, the ability to control your time is one of the most fulfilling forms of financial freedom.

8. Entrepreneurial or Investment Freedom

Once you’ve reached a level of financial independence and gained freedom over your time, the next stage many Elephants aim for is entrepreneurial or investment freedom. This is the ability to take financial risks without relying on external funding or risking your personal finances. In other words, you have enough capital saved or invested that you can fund new business ventures or explore high-return investment opportunities without worrying about jeopardising your financial stability.

Entrepreneurial freedom is often about pursuing passion projects or launching businesses that excite you, even if they come with some financial risk. Unlike traditional entrepreneurs who might need to take out loans or attract investors, financial freedom gives you the flexibility to fund your ventures with your own money. This removes the pressure of making quick returns or dealing with the demands of outside stakeholders, allowing you to explore ideas that align with your interests and values.

One example of using entrepreneurial freedom is investing in high-potential sectors like defence stocks or emerging technologies. If you’ve accumulated enough wealth, you can pursue investments that may require patience but have the potential for substantial long-term returns. Our guide on What Defence Stocks to Buy Now to Be Ready for 2025 discusses how defence and technology sectors can offer opportunities for those looking to make more specialised investments.

For investors, this level of financial freedom also means having the capital to diversify your portfolio without being forced to rely on high-risk, high-reward strategies just to stay afloat. By having a robust financial base, you can allocate funds to innovative but riskier projects, like venture capital investments, or tap into markets that require significant upfront capital, such as real estate or private equity. You can afford to take these risks because your financial security isn’t reliant on the success of a single venture.

Entrepreneurial freedom provides a sense of creative autonomy. You can follow your instincts, take on challenges that genuinely excite you, and potentially leave a lasting impact through your investments or businesses. The best part? Even if one project doesn’t succeed, your financial future remains intact, giving you the confidence to keep exploring and innovating.

9. Minimalist Approach

The minimalist approach to financial freedom might seem counterintuitive in a world that often equates success with more wealth, more possessions, and more status. However, for some Elephants, true financial freedom comes not from accumulating more but from needing less. The minimalist approach focuses on reducing material needs and financial dependence by simplifying your lifestyle. It’s about finding contentment in living within your means—sometimes even well below them—and focusing on what truly brings you happiness.

Minimalism in finance can take many forms. It might mean downsizing your home, choosing public transport over a car, or cutting back on luxury purchases that don’t significantly improve your quality of life. The core idea is to reduce your financial obligations, which in turn reduces your need to work and accumulate wealth. If you can live on a smaller income, you need less passive income to achieve financial independence, which can allow you to reach financial freedom faster.

One of the benefits of the minimalist approach is that it encourages people to align their spending with their values. Instead of chasing wealth for wealth’s sake, minimalists focus on spending money on what brings genuine happiness and fulfillment. For some, this might mean spending on travel or experiences rather than material goods. For others, it could mean investing in sustainability or supporting causes they care about.

Living a minimalist financial lifestyle also protects you from emotional-driven investments. Many people get swept up in market trends, like the meme stock frenzy we saw in recent years, only to end up with losses. By focusing on simplicity and sustainability in your finances, you’re less likely to be influenced by hype or make impulsive decisions that could harm your financial stability. To learn more about the dangers of emotionally-driven investments, check out our article on Why Investing With Your Heart Can Hurt Your Wallet.

Minimalist financial freedom isn’t about poverty or denying yourself the things you love—it’s about intentional living. By consciously reducing unnecessary expenses, you can focus on the things that matter most, whether that’s spending time with loved ones, pursuing creative projects, or simply enjoying a slower, more peaceful lifestyle. It’s a reminder that financial freedom is ultimately about the freedom to live life on your own terms.

10. Finding Your Version of Financial Freedom

As we’ve journeyed through the different stages of financial freedom, it’s clear that the concept is as diverse as the Elephants themselves. From achieving basic financial stability to leaving a legacy, each stage reflects a different dimension of what it means to be financially free. The path you take will depend on your own goals, values, and circumstances. For some, it’s about building a wealthy empire to pass on to future generations. For others, it’s about living simply and focusing on the things that bring true joy, like time, freedom, and personal growth.

The beauty of financial freedom is that there’s no one-size-fits-all approach. Whether you’re aiming for early retirement, entrepreneurial ventures, or simply the peace of mind that comes from knowing your basic needs are covered, the steps we’ve discussed are building blocks to achieving that freedom.

No matter where you are on this path, remember that financial freedom isn’t a destination—it’s a journey. Each step brings you closer to living life on your terms, with less stress and more freedom to focus on what truly matters. And as always, we at ElephantInvestor are here to support you along the way, providing insights and strategies to help you reach your financial goals.

Now, it’s your turn to decide what financial freedom means to you and start working towards it. Whether you’re just getting started or already well on your way, there’s always room to refine your financial strategy and move closer to the life you envision. Let’s continue to grow together, Elephants!