Hello Elephants! When it comes to building wealth through the stock market, growth stocks often grab the spotlight. These are shares in companies that are expected to grow faster than the market average. Unlike value stocks, which focus on stability and dividends, growth stocks rely on reinvesting profits to fuel rapid expansion. For those willing to take on more risk in pursuit of higher returns, growth stocks can offer exciting opportunities—but they also come with potential pitfalls. Let’s dive into what growth stocks are, their key characteristics, and the risks involved in investing in them.

What Are Growth Stocks?

Growth stocks are shares in companies that are expected to grow at a faster rate than the overall market. Unlike more stable stocks that may pay regular dividends, growth companies typically reinvest their profits back into the business to fuel further expansion. This reinvestment strategy allows them to innovate, scale up, and increase their market share. For investors, this means that the primary way to make money with growth stocks is through capital appreciation—the increase in the stock’s price over time—rather than from dividends.

As one source explains, “Growth stocks are shares in companies expected to grow at an above-average rate compared to other publicly traded companies” (Chase). This makes them particularly appealing to investors who are looking for potentially high returns, but they also come with a higher risk due to their dependence on future growth.

No Dividends—All About Reinvestment

Growth stocks are different from companies that pay dividends, like value stocks. Dividends are payments that some companies give to their shareholders, usually from profits. However, most growth companies don’t pay dividends. Why? Because instead of distributing profits to shareholders, they use the funds to reinvest in the business. This helps them grow even faster by developing new products, improving technology, or expanding their operations.

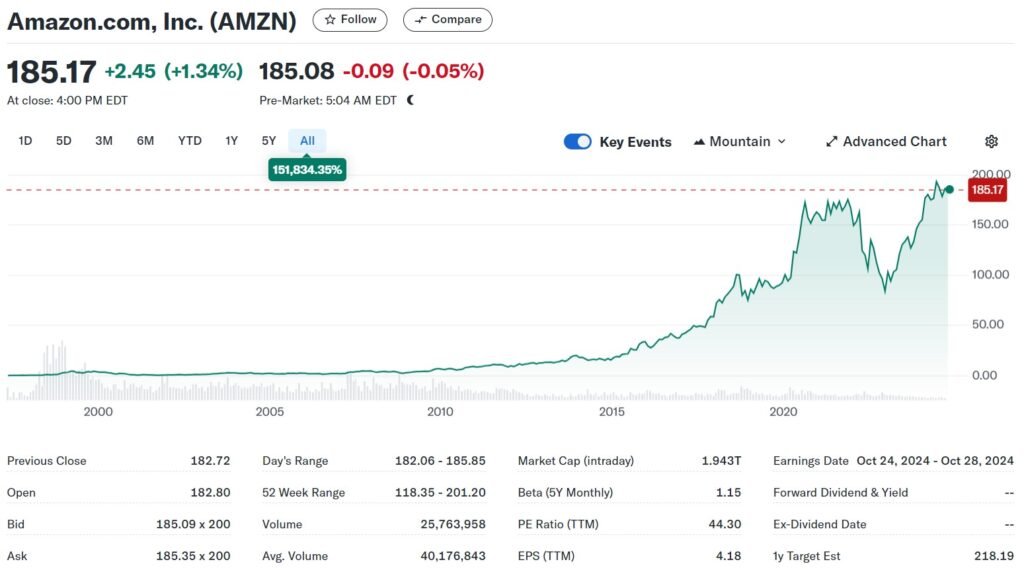

For example, a company like Amazon, which has historically been considered a growth stock, reinvests a significant portion of its earnings into research, development, and infrastructure. Over time, this strategy has allowed Amazon to expand into multiple sectors and maintain its dominance.

Profits Come from Selling Shares

Since growth companies don’t pay dividends, the only way investors make money is through capital gains—which means they need to sell their shares at a higher price than what they bought them for. If the company performs well and continues growing, the stock price is likely to rise. But if the company fails to meet growth expectations, the stock price can fall dramatically, leaving investors with a potential loss.

A good example of this is Nvidia. Its rapid growth has led to significant stock price appreciation, rewarding early investors who bought shares years ago. The focus on reinvestment and innovation has driven its stock price up, but if growth slows, the high stock price could tumble, showing the balance of reward and risk with growth stocks.

For more on how much to invest in stocks like these, check out our detailed guide on How Much Should I Invest in the Stock Market?. This will help you balance risk and potential returns when considering growth stocks as part of your portfolio.

Key Characteristics of Growth Stocks

Growth stocks share some important traits that set them apart from other types of investments. These characteristics help explain why they are often seen as expensive but also why they can offer great potential for returns. Typically, growth stocks come from companies that are at the forefront of innovation and have significant potential to expand in the future.

High Price-to-Earnings (P/E) Ratios

One of the most noticeable features of growth stocks is their high price-to-earnings (P/E) ratio. The P/E ratio is a way to measure how expensive a stock is compared to the company’s earnings. In simple terms, it shows how much investors are willing to pay for £1 of the company’s earnings. Growth stocks often have higher P/E ratios than other types of stocks because investors expect these companies to continue growing rapidly, even if their current earnings are low or non-existent.

For instance, investors might pay a high price for a stock like Nvidia or Amazon because they believe that, in the future, the company’s growth will justify the current high price. These stocks may seem pricey, but as Investopedia notes, “Growth stocks often look expensive, trading at a high P/E ratio, but such valuations could actually be cheap if the company continues to grow rapidly, which will drive the share price up” (Investopedia).

While the high P/E ratio signals growth potential, it also brings risk. If a company doesn’t meet these high expectations, its stock price can drop sharply, leading to significant losses for investors. This is why growth stocks are often seen as both high-reward and high-risk.

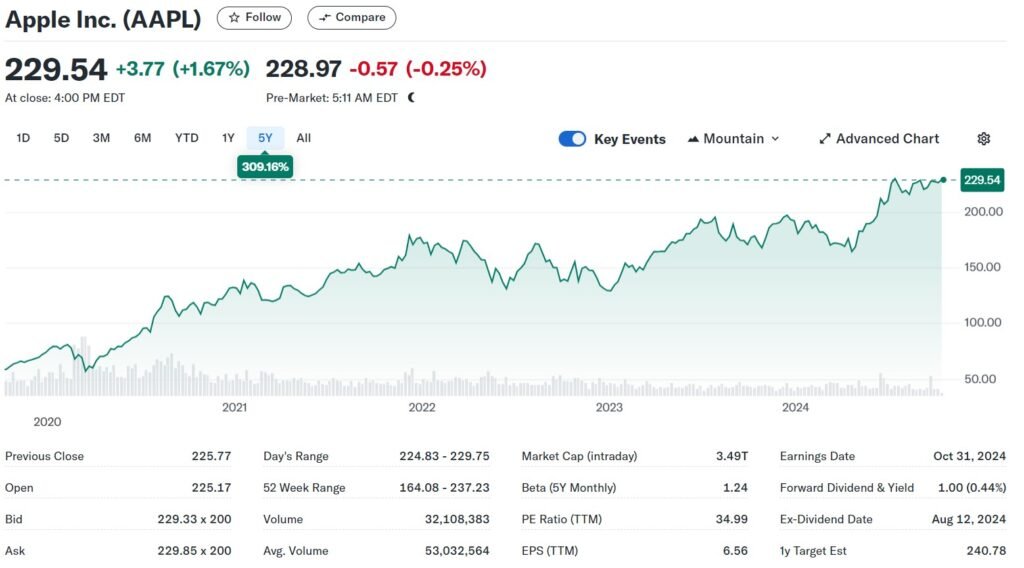

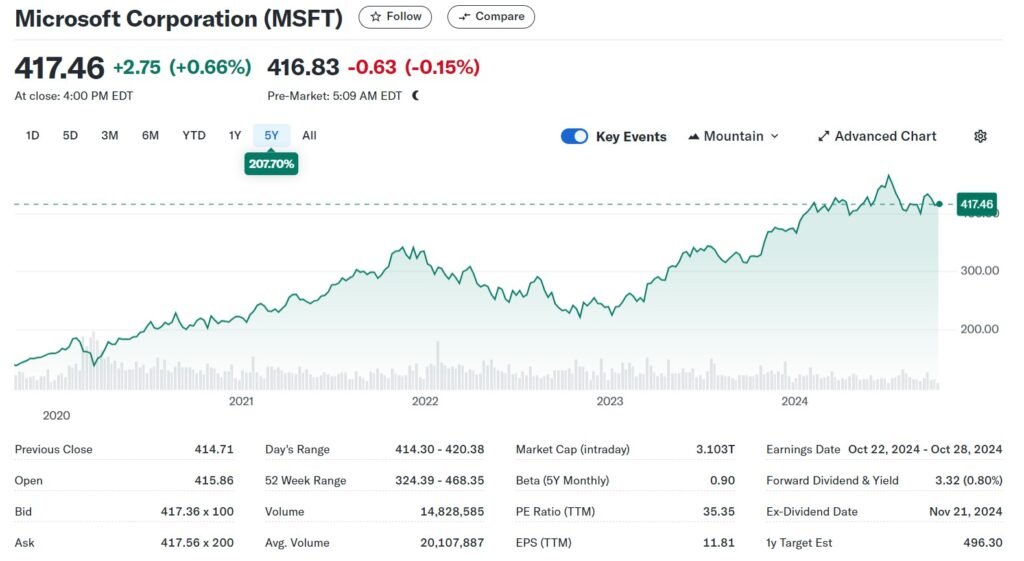

Innovation, Market Dominance, and Big Customer Bases

Growth companies typically offer innovative products or services that set them apart from their competitors. They are often pioneers in their field, developing new technologies or creating entirely new markets. These companies are also known for holding patents or having proprietary technologies that give them a competitive edge. For instance, Apple and Microsoft started as growth stocks because they introduced groundbreaking technologies that no one else had, and their early dominance helped them become market leaders.

In addition to their innovation, growth stocks often enjoy significant market share. This means they either dominate their industry or have the potential to do so. For example, a tech company developing a unique application might become a growth stock if it attracts a large number of users. The bigger the customer base, the more room there is for future growth.

Growth stocks are frequently found in fast-growing sectors, such as technology and biotechnology. These sectors are constantly evolving, and companies within them are driven by research, development, and innovation. Industries like biotech are prime examples of sectors where growth stocks can thrive. A biotech firm working on a new cancer treatment, for instance, could see massive gains if its treatment becomes successful, but the risks of failure are just as high.

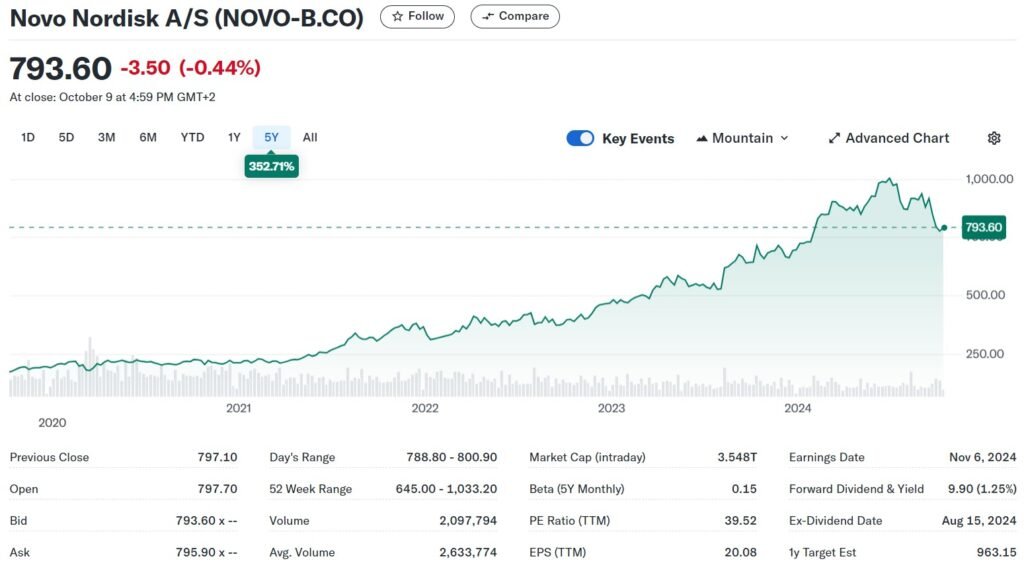

For a real-world look at how these characteristics can play out, take a look at our piece on Novo Nordisk: Time to Invest?. Novo Nordisk has used innovation in healthcare to become a growth leader in its field, much like the tech giants in their respective sectors.

Understanding these traits can help you spot growth stocks, but it’s important to remember that even though they show a lot of promise, they come with risks, especially if a company’s innovation doesn’t pay off or it loses its competitive advantage.

Risks of Investing in Growth Stocks

While growth stocks can offer significant returns, they also come with substantial risks. The very same factors that drive their rapid growth—such as innovation, reinvestment, and high market expectations—can also turn against them if things don’t go as planned. Unlike value stocks, which often pay dividends and provide more stable income, growth stocks can leave investors vulnerable if the company’s growth doesn’t meet expectations. Here’s why growth stocks can be a risky proposition.

Uncertainty of Future Growth

One of the biggest risks with growth stocks is the uncertainty of future growth. Growth companies are often valued based on what investors believe they will achieve in the future, rather than their current performance. This means that if the company fails to deliver the expected results, its stock price can fall dramatically, and investors might face significant losses.

As Bajaj Broking explains, “The main risk is that the realized or expected growth doesn’t continue into the future. Investors have paid a high price expecting one thing and not getting it. In such cases, a growth stock’s price can fall dramatically” (Bajaj Broking). For instance, a tech company that promises revolutionary new software but fails to release it on time or faces unexpected technical issues may see its stock price plummet, leaving investors disappointed.

Moreover, the competitive landscape for growth companies is often fierce. If a competitor launches a similar product or technology, it can erode the market share of the growth company, limiting its ability to expand. Investors in growth stocks need to be aware of these external risks and the fact that rapid growth is not guaranteed.

No Regular Income from Dividends

Unlike value stocks, growth stocks typically do not offer regular income in the form of dividends. Dividends are payments some companies make to shareholders as a way to distribute profits. Since growth companies reinvest most of their profits to fund expansion, they usually don’t pay dividends. This means that investors only profit when they sell their shares at a higher price, which can take years to achieve.

For long-term investors, this lack of dividends can be a disadvantage. During holding periods, there’s no income stream from the investment. If the company doesn’t meet its growth targets or suffers a setback, investors may have to hold on to the stock for even longer or sell at a loss.

This is where growth investing can feel particularly risky. Unlike dividend-paying stocks, where you still receive income even if the stock price doesn’t rise, growth stocks provide no safety net. If a company goes through a rough patch, such as an economic downturn or increased competition, you could be left waiting for growth that may never materialise. For example, during the dot-com bubble, many tech growth stocks were valued based on future potential, but when those companies failed to deliver, their stock prices collapsed, and investors lost large amounts of money.

For a real-world look at this dynamic, consider Nvidia. While its stock price surged due to high demand for its chips, any slowdown in growth or failure to meet expectations could lead to a sharp decline in its share value. Check out our piece on Why Nvidia’s Stock Price Is Surging to understand how quickly fortunes can change in the world of growth stocks.

Growth investing can be highly rewarding, but it’s important to understand that with high returns comes high risk. The lack of dividends and reliance on future performance make growth stocks more volatile, and only investors with a long-term horizon and strong risk tolerance should consider them.

Growth Stocks vs. Value Stocks

When investing in stocks, you’ll often hear about two main types: growth stocks and value stocks. Each offers a different strategy for investors, and it’s important to understand how they contrast. Growth stocks are all about future potential, while value stocks focus on being currently undervalued by the market. Let’s take a closer look at how these two types differ and why some investors might include both in their portfolios.

Future Potential vs. Current Value

Growth stocks are companies that are expected to grow faster than the market average. They tend to have higher price-to-earnings (P/E) ratios, meaning investors are willing to pay more for each £1 of earnings because they expect the company’s earnings to increase significantly in the future. As we’ve discussed, growth stocks usually reinvest their profits into the business, focusing on expansion, innovation, and capturing market share. This reinvestment means they typically don’t pay dividends.

On the other hand, value stocks represent companies that are currently undervalued by the market. These companies often have lower P/E ratios and pay regular dividends, which provide a steady income to shareholders. Value stocks are often from well-established companies that may not be growing rapidly but have strong fundamentals and stable earnings. Investors buy value stocks with the belief that the market has undervalued them, and their price will eventually rise as the company’s true worth becomes recognised.

As Investopedia explains, “Growth stocks differ from value stocks… Value stocks trade below what they are really worth and will thus theoretically provide a superior return as their stock prices catch up with fundamentals” (Investopedia). In other words, value stocks are seen as safer, offering steady returns through dividends and modest stock price appreciation, while growth stocks are riskier but have the potential for much higher returns.

Balancing Growth and Value Stocks

Some investors choose to balance both growth and value stocks in their portfolios for diversification. This approach helps spread the risk while giving the portfolio the potential for strong gains from growth stocks and the stability and income from value stocks. Growth stocks can provide high returns if the companies deliver on their expected growth, while value stocks can act as a cushion during periods of market volatility, as they tend to be more stable and less sensitive to economic fluctuations.

For example, an investor might hold shares of a high-growth tech company like Nvidia or Amazon alongside value stocks from more stable sectors, like consumer goods or energy. This way, the portfolio benefits from the rapid appreciation potential of growth stocks while also generating consistent income from value stocks’ dividends.

You can read more about how value stocks work and how to spot them in our guide, Understanding Value Stocks. This will give you a deeper understanding of how to blend these two approaches in your investment strategy.

By combining both growth and value stocks, investors can create a well-rounded portfolio that captures the benefits of both strategies. While growth stocks may offer higher returns over time, value stocks provide stability and income, making the overall investment strategy more balanced and less volatile.

Examples of Growth Stocks

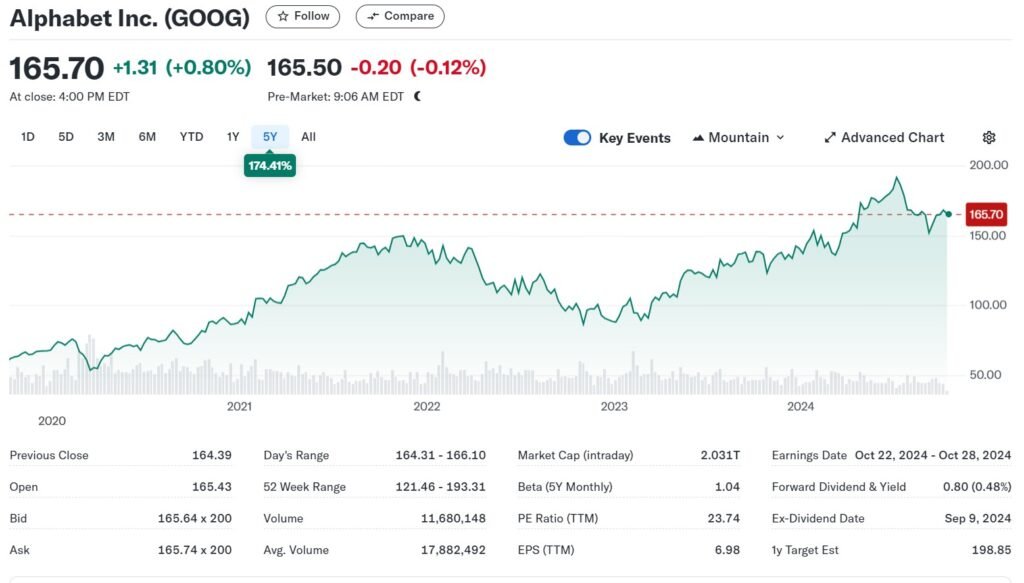

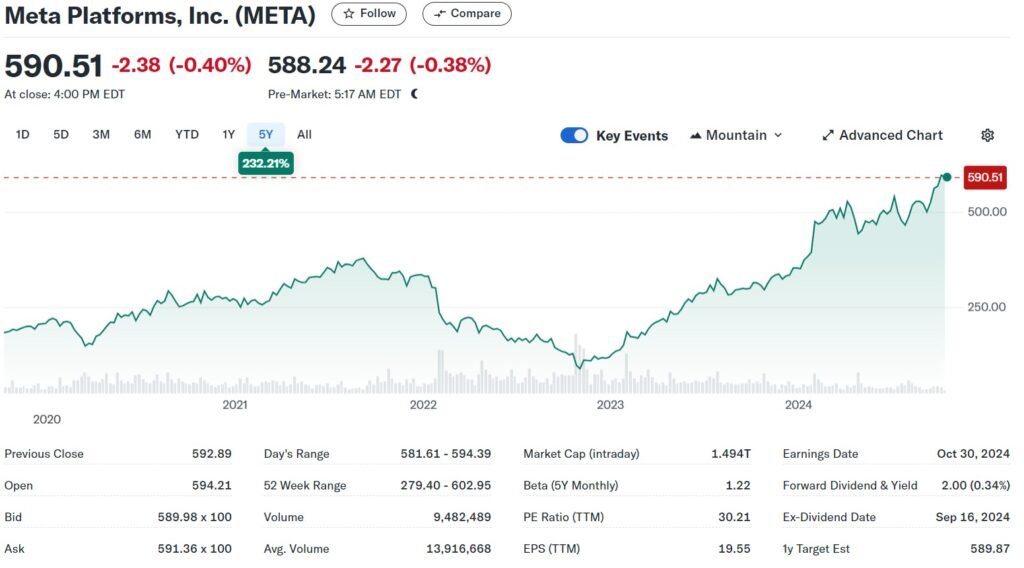

Some of the most exciting and well-known companies in the stock market are growth stocks. These are often the businesses that dominate headlines, driven by innovation and rapid expansion. Companies like Nvidia, Alphabet, and Meta have all demonstrated exceptional growth, making them popular choices for investors looking to capitalise on their success. Let’s take a look at some real-world examples of growth stocks and how their performance illustrates the potential rewards of investing in them.

Nvidia, Alphabet, and Meta: Big Names in Growth Stocks

One of the most prominent examples of a growth stock is Nvidia. Known for designing high-performance computer chips, Nvidia has experienced extraordinary growth over the past decade. Its revenue grew by an incredible 122% year over year in 2023, while its net income surged by 168%. As U.S. News highlights, Nvidia’s expansion into areas like artificial intelligence (AI) and edge computing continues to drive future growth expectations (U.S. News). Investors who got in early have seen substantial returns, and Nvidia’s stock remains a prime example of how innovation and market dominance can lead to significant capital appreciation.

Alphabet —the parent company of Google and YouTube—is another key growth stock. Alphabet has consistently reported strong revenue growth, particularly in its Google Cloud services, which saw a 28% rise in 2023. With the increasing integration of AI in its advertising and cloud services, Alphabet is well-positioned for future growth. According to analysts, Alphabet is expected to maintain at least 10% annual revenue growth through 2025, making it a favourite among growth investors (U.S. News).

Then there’s Meta Platforms (formerly Facebook), which has made a significant comeback as a growth stock. Meta reported an impressive 22% revenue growth in 2023, largely driven by its advertising business and platforms like Instagram. Analysts predict that Meta will generate over £45 billion in free cash flow by 2024, with at least 10% annual earnings per share (EPS) growth through 2025 (U.S. News).

These companies show that when a business leads in innovation and successfully scales its operations, it can deliver spectacular returns for investors. However, these examples also come with high expectations and significant risks, as the companies must continue to meet or exceed growth forecasts to maintain their stock price.

Other Top Growth Stocks to Watch

Beyond these big names, there are several other high-performing growth stocks worth noting, each with strong growth potential:

- Advanced Micro Devices (AMD): AMD’s data centre and graphics processors have been a massive hit. The company posted 27% revenue growth for 2025, with net income surging 881% in 2023.

- Salesforce (CRM): As a leader in customer relationship management software, Salesforce has grown through acquisitions and solid market presence, with projected revenue growth of 7-9% annually through 2027.

- Mastercard (MA): A global payments giant, Mastercard’s innovative approach to financial technology has kept it growing. It’s expected to see 12% revenue growth in 2024 and 13% in 2025.

- ServiceNow (NOW): With AI technology integration, ServiceNow is forecasted to grow by 21% in 2024 and 20% in 2025, making it a solid growth stock in the cloud services space.

Investing in these types of companies can be incredibly rewarding, but it’s important to remember that not all growth stocks will achieve such heights. The key is to carefully research each company’s growth prospects, financial health, and market position before deciding to invest.

How to Invest in Growth Stocks

Investing in growth stocks can be highly rewarding, but it requires careful research and a thoughtful approach. Growth stocks often come from companies with innovative ideas and the potential to expand rapidly, but they also come with risks. To make smart investments in growth stocks, you need to understand both the industry and the company’s financial health. Below, we’ll discuss some key strategies for investing in growth stocks and how to reduce risk through diversification.

Research and Financial Analysis

Before diving into growth stocks, it’s important to research the industries where these companies operate. Growth stocks often come from sectors like technology, healthcare, or biotech—industries known for rapid innovation. By looking at industries that are expected to expand faster than the market average, you can identify companies with high growth potential. For example, tech giants like Nvidia and Meta lead in sectors like AI and social media, where innovation drives continuous growth.

Once you’ve identified an industry, the next step is to analyse the company’s financial performance. Growth stocks tend to have high price-to-earnings (P/E) ratios, but it’s essential to know whether these high valuations are justified by the company’s growth prospects. The P/E ratio measures how much investors are willing to pay for each £1 of earnings, and a high P/E suggests that investors expect strong future growth.

However, the P/E ratio can sometimes be misleading. That’s why some investors also consider the price-to-earnings growth (PEG) ratio, which takes into account the company’s earnings growth rate. A high PEG ratio indicates strong growth potential and is considered a more reliable indicator than just the P/E ratio. As Bajaj Broking explains, “Investors also consider the price-earnings to growth (PEG) ratio, which takes into account the company’s earnings per share growth rate” (Bajaj Broking).

In addition to these ratios, look at other financial metrics like revenue growth, profit margins, and return on equity (RoE). Companies with strong sales growth, increasing market share, and high RoE values tend to be good candidates for growth stock investments. For example, Alphabet and Salesforce have consistently shown strong earnings growth, positioning them as reliable growth stocks in their respective industries.

Diversification and Growth-Focused Funds

While investing in individual growth stocks can yield high returns, it’s important to diversify your portfolio to reduce risk. Growth stocks can be volatile, and if you put all your money into a single company or industry, a downturn could significantly impact your portfolio. Diversification means spreading your investments across different companies, sectors, and even asset types.

One way to diversify is to invest in growth mutual funds or exchange-traded funds (ETFs) that focus on growth stocks. These funds hold shares in a variety of growth companies, giving you broad exposure to different sectors without the risk of picking individual stocks. For example, the Vanguard Growth ETF (VUG) or the iShares Russell 1000 Growth ETF (IWF) are popular options for investors looking to gain exposure to growth stocks across various industries.

These funds are managed by professionals who use financial analysis to select high-potential growth stocks. They offer a convenient way to invest in growth stocks while reducing the risk of individual stock volatility. As Bajaj Broking notes, “Investing in growth mutual funds or exchange-traded funds (ETFs) that focus on growth stocks…are managed by professional fund managers who have the expertise and resources to select the best growth stocks for you” (Bajaj Broking).

By combining growth stocks with a diversified portfolio or a growth-focused ETF, you can enjoy the potential for high returns while managing risk. If you want to learn more about building a well-balanced stock portfolio, check out our guide on How Much Should I Invest in the Stock Market?.

Investing in growth stocks takes patience and research, but with the right strategy, you can position yourself for long-term financial success. By analysing industries, studying financial metrics, and diversifying your investments, you can navigate the exciting—but risky—world of growth stocks.

So basically…

As part of the Elephant herd, you know that great rewards often come with careful steps. Growth stocks are like young elephants in the wild—full of potential but needing time to grow strong.

While they may not offer steady income through dividends, their ability to charge ahead with innovation can lead to impressive returns. But remember, the path can be risky, and not every stock will reach its full strength. By doing your research and diversifying your investments, you can balance the risks and navigate this journey toward long-term gains.

Stay patient, stay focused, and your portfolio could grow as mighty as an elephant.