Hello Elephants! The tech jungle is rumbling, and one of its mightiest giants—Google, or more precisely its parent company, Alphabet—finds itself in a legal storm of epic proportions. The U.S. Department of Justice (DOJ) has won a significant case, accusing Google of maintaining an illegal monopoly, especially in the realm of search engines. This ruling could shake the ground not only beneath Google but also for users, competitors, and—perhaps most importantly—investors like us. Let’s unpack this legal saga to understand how it might affect the herd.

What’s at the Heart of the DOJ’s Case Against Google?

Google has long been the dominant player in the search engine market, and most of us use it daily to navigate the web. However, the DOJ has accused Google of using its size and power to unfairly block competitors from gaining ground. Specifically, they argue that Google’s practice of paying enormous sums to companies like Apple and Samsung to ensure its search engine is the default on smartphones and browsers constitutes illegal monopolistic behaviour.

In 2021 alone, Google reportedly paid a staggering $26.3 billion to maintain its position as the default search engine on key devices such as the iPhone. As a result, Google now controls about 91% of the global search engine market—an elephant-sized chunk—leaving only about 4% for rivals like Microsoft’s Bing and smaller search engines like DuckDuckGo.

For some perspective, most companies can only dream of achieving such dominance. However, the court ruled that Google’s business practices crossed a line from smart business to illegal monopoly behaviour, particularly because these deals make it extremely difficult for smaller competitors to compete on a level playing field.

The Numbers Behind Google’s Dominance

To fully grasp the scale of this case, let’s look at the figures. By controlling over 90% of the market, Google effectively shapes the flow of information for billions of users worldwide. More than just a search engine, Google’s ecosystem ties in advertising, mobile devices, apps, and even cloud services, making its grip on the digital world nearly inescapable. Its main competitors, like Microsoft’s Bing, struggle to even break single-digit percentages of market share.

For investors, Google’s monopoly raises questions about the sustainability of such dominance. Could this ruling mean a seismic shift in the tech landscape? And how might a forced restructuring of Google impact its stock? We’ll dive into those questions next. For further insights on navigating such legal challenges, you can explore our guide on understanding value stocks.

The Impact of a Monopoly Ruling: Could Google Be Forced to Break Up?

Now that Google has been officially labelled a monopoly, the DOJ is examining several potential remedies. One of the most extreme—and most talked about—possibilities is the forced breakup of Alphabet’s vast business empire. If this happens, Google could be required to sell or spin off key components like its Chrome browser and Android mobile operating system. Let’s take a closer look at what that might mean.

A World Without Google Chrome or Android?

Breaking up Alphabet would have massive consequences, not just for Google but for the entire tech ecosystem. Google Chrome, the world’s most-used internet browser, and Android, which powers about 85% of all smartphones globally, are both pillars of Google’s dominance. Losing control over these platforms would significantly reduce the company’s reach, influence, and profitability.

For example, without Chrome, Google would lose one of its primary ways of funnelling users into its search engine and collecting data to fuel its advertising empire. And Android? If Google no longer controls the operating system that powers the majority of the world’s smartphones, it would dramatically shrink its influence in the mobile space.

For investors, this presents both risk and opportunity. While Google’s stock could take a hit from such a breakup, the newly independent companies might present fresh opportunities. Imagine a standalone Android or Chrome business—these could become attractive investments in their own right. For more on managing such risks in volatile times, check out our guide on how much to invest in the stock market.

Google’s Defence: Just Business, or Monopoly?

Not surprisingly, Google has fiercely defended itself against the DOJ’s accusations. The company argues that its search engine is popular simply because it’s better than the competition. According to Google, consumers choose their search engine voluntarily because it offers superior results, not because they’re being forced to. They emphasise that users can easily switch to alternatives like Bing or DuckDuckGo if they choose.

Furthermore, Google claims that it faces stiff competition in other areas. For instance, when it comes to searching for products, users often bypass Google entirely and head directly to platforms like Amazon. Google’s defence boils down to this: they’re being punished for providing a superior service that users prefer.

However, the court didn’t buy it. While Google has a point about competition existing in specific sectors, the broader picture tells a different story. With 91% market share, Google’s competitors barely stand a chance. The DOJ and the courts concluded that Google’s payments to companies like Apple to secure default status amounted to stifling the competition and unfairly boosting its own position in the market.

What Happens Next: Potential Penalties and Remedies

So, what’s next for Google? The DOJ is still working on a proposal for penalties, but final decisions are expected by the end of 2025. The potential punishments range from financial fines to more structural changes, such as restrictions on how Google can operate its search business. The most drastic option on the table is forcing Alphabet to break up, which could reshape the entire tech industry.

Could Google Be Forced to Split?

Let’s explore what a breakup might actually look like. Imagine a scenario where Alphabet has to sell off its core products, such as Google Search, Chrome, or Android. The separation of these businesses would weaken Google’s influence but also create space for competitors to gain ground. A standalone Android business, for example, could focus solely on mobile innovation without the shadow of Google’s other interests looming over it. Chrome could evolve as an independent browser company, possibly offering new investment opportunities.

For us Elephants, the prospect of a Google breakup raises important questions. How would this affect the stock price? Would the new entities become attractive for investors? Historically, similar antitrust cases, like the one involving Microsoft in the early 2000s, resulted in some market disruption but also paved the way for new growth. You can dive deeper into these historical examples and their long-term effects in our value stock guide.

Google vs. Microsoft: Learning from the Past

Speaking of Microsoft, Google isn’t the first tech giant to face accusations of monopolistic behaviour. Back in the late 1990s, Microsoft was similarly accused of abusing its dominance in the operating system market by bundling Internet Explorer with Windows. The DOJ argued that this gave Microsoft an unfair advantage over other web browsers, effectively squeezing competitors out of the market.

The outcome? The court ruled in favour of the DOJ, and while Microsoft was not ultimately broken up, it was forced to change its business practices significantly. Restrictions were placed on how it could bundle its software, and the case led to greater competition in the web browser market. Microsoft’s dominance was curtailed, but the company adapted and is still one of the most valuable companies in the world today.

Could Google face a similar fate? It’s possible. Even if the DOJ doesn’t break up Alphabet, we can expect new regulations that could limit Google’s ability to make exclusive deals or force them to open up their platforms to competitors. Investors should prepare for potential stock volatility as these decisions unfold.

The Global Context: Google’s Legal Battles Beyond the U.S.

It’s important to note that the U.S. isn’t the only place where Google is under fire. In Europe, Google has already faced major fines for its anticompetitive practices. Led by competition commissioner Margrethe Vestager, the European Union has been particularly aggressive in curbing Big Tech’s power. In 2018, the EU fined Google a record-breaking $5 billion for forcing Android phone manufacturers to pre-install Google apps, including Google Search and Chrome.

The U.S. ruling may encourage regulators in other regions to follow suit, resulting in even more legal challenges for Google. For instance, India and South Korea are also tightening their scrutiny of Big Tech, with similar concerns over market dominance. In fact, the global push to regulate tech giants like Google, Meta (Facebook), and Amazon is gathering momentum, and this ruling could be the start of even more restrictive policies in other regions. You can explore more about global tech regulations in this Berlingske article.

What It Means for Investors: Risks and Opportunities

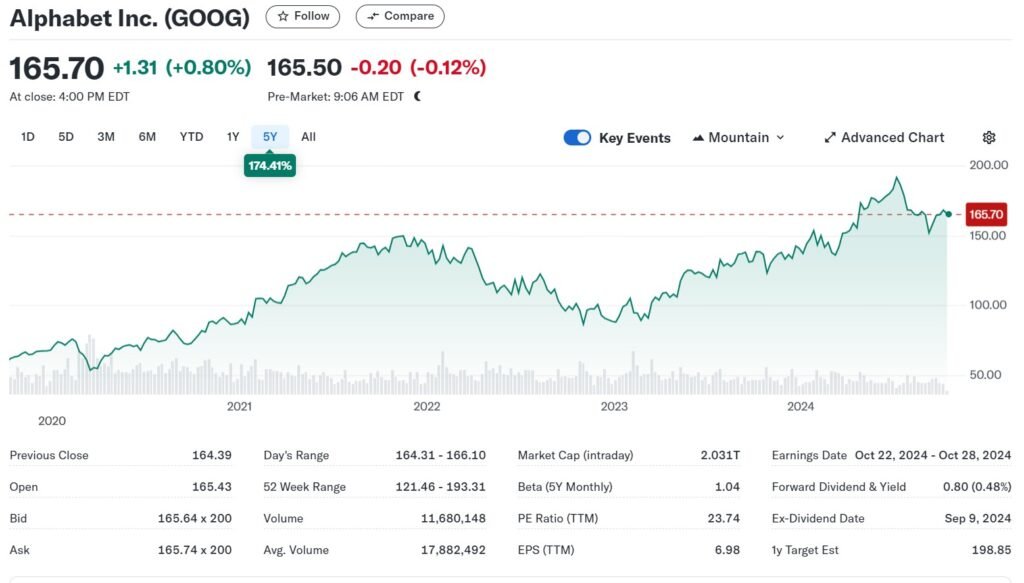

Elephants, as we watch these legal developments unfold, it’s important to consider the potential impact on your portfolios. Legal challenges like these often cause short-term stock price volatility. Google’s stock has already seen some dips as the DOJ case has progressed, and we can expect further fluctuations as the final rulings come in.

Short-Term Risks: Expect Vol

atility

Whenever a giant company like Google faces legal troubles, stock prices can swing. Uncertainty makes investors nervous, and those with lower risk tolerance may choose to sell off their shares. For seasoned investors, these price drops can sometimes represent buying opportunities, particularly if you believe Google will weather the storm and adapt to any regulatory changes.

If you’re unsure how to handle potential volatility, it’s worth reviewing our guide on how much you should invest in the stock market for strategies on managing risk.

Long-Term Outlook: A New Tech Landscape?

Looking further ahead, the outcome of these legal battles could reshape not just Google but the entire tech industry. If Google is forced to sell off parts of its business or change its practices, this could give competitors more room to innovate and grow. For investors, this opens the door to new opportunities. A breakup of Google’s core assets, such as Chrome or Android, could create new investment opportunities as these businesses become independent entities.

Additionally, if Google’s dominance in digital advertising is curbed, other companies, such as Microsoft, Amazon, or even newer tech startups, could gain market share, making them attractive to investors looking for growth in the tech space. The shifting landscape could also benefit those who focus on long-term value stocks. For more on this, check out our guide to spotting value stocks.

What Should Investors Do?

So, what should we, the elephants of the investing world, do with this information? The key takeaway is to stay informed and flexible. While legal battles like these create uncertainty, they also bring potential opportunities. If Google is forced to change its business model, it could still emerge as a strong, more focused company. Alternatively, if parts of Google are sold off, the newly independent companies might present attractive investment options.

Change always brings risk, but for those who remain patient and strategic, it can also bring reward. Keep following ElephantInvestor for updates on these developments and for more insights on how this could impact your investment strategy.

Sources:

https://www.berlingske.dk/virksomheder/banebrydende-dom-google-fastholder-ulovligt-monopol-med-store

https://www.berlingske.dk/virksomheder/usa-overvejer-historisk-indgreb-vil-maaske-splitte-google-op

https://www.berlingske.dk/virksomheder/apple-og-google-taber-milliardslagsmaal-mod-vestager